Elevate Your Banking Experience With Debt Unions

Discovering the world of banking experiences can typically lead to discovering covert gems that use a refreshing departure from traditional financial institutions. Lending institution, with their focus on member-centric solutions and area participation, present a compelling choice to traditional banking. By focusing on specific demands and fostering a feeling of belonging within their membership base, lending institution have sculpted out a specific niche that reverberates with those looking for an extra individualized strategy to managing their finances. What sets them apart in terms of boosting the financial experience? Let's delve deeper into the one-of-a-kind advantages that debt unions give the table.

Benefits of Lending Institution

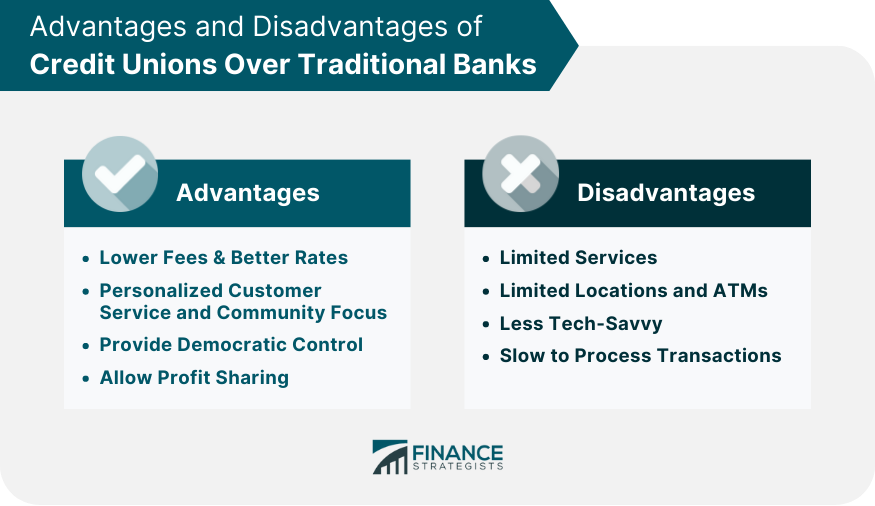

An additional benefit of debt unions is their autonomous structure, where each member has an equal vote in electing the board of directors. Debt unions typically supply economic education and therapy to help members improve their financial literacy and make informed decisions about their money.

Subscription Requirements

Cooperative credit union generally have details standards that people must satisfy in order to enter and access their financial solutions. Subscription demands for credit score unions often involve qualification based upon factors such as a person's place, company, business affiliations, or other certifying partnerships. Some credit scores unions may serve individuals who live or function in a particular geographic location, while others may be affiliated with particular companies, unions, or associations. In addition, family participants of present cooperative credit union participants are typically eligible to join too.

To become a participant of a lending institution, individuals are generally required to open an account and preserve a minimum deposit as defined by the institution. Sometimes, there might be single subscription fees or ongoing subscription fees. As soon as the membership criteria are fulfilled, people can appreciate the benefits of coming from a lending institution, including access to customized economic solutions, affordable interest prices, and an emphasis on participant complete satisfaction.

Personalized Financial Services

Personalized monetary services customized to private needs and choices are a trademark of lending institution' commitment to participant contentment. Unlike conventional financial institutions that frequently supply one-size-fits-all options, cooperative credit union take a much more personalized method to managing their members' financial resources. By recognizing the unique goals and situations of each participant, credit report unions can supply tailored referrals on savings, financial investments, recommended you read fundings, and various other economic products.

Additionally, lending institution generally offer lower charges and competitive rates of interest on financial savings and loans accounts, better improving the individualized economic services they offer. By concentrating on specific demands and supplying customized remedies, credit history unions establish themselves apart as trusted financial partners dedicated to assisting members thrive economically.

Area Involvement and Assistance

Neighborhood involvement is a foundation of cooperative credit union' goal, reflecting their commitment to sustaining regional initiatives and fostering meaningful connections. Lending institution actively join area occasions, sponsor local charities, and organize monetary literacy programs to enlighten non-members and participants alike. By buying the neighborhoods they offer, lending institution not just strengthen their relationships however likewise add to the total health of culture.

Supporting local business is one more means lending institution show their dedication to regional communities. Through supplying bank loan and financial advice, credit history unions help business owners grow and boost economic development in the area. This assistance goes beyond just financial aid; lending institution often supply mentorship and networking opportunities to help tiny businesses do well.

Moreover, cooperative credit union frequently engage in volunteer job, urging their employees and participants to repay with various social work tasks - Hybrid Line of Credit. Whether it's participating in neighborhood clean-up occasions or organizing food drives, credit history unions play an energetic function in boosting the lifestyle for those in demand. By prioritizing area involvement and assistance, credit scores unions truly personify the spirit of teamwork and mutual assistance

Online Banking and Mobile Applications

Credit report unions are at the center of this digital change, offering participants protected and hassle-free methods to handle their finances anytime, anywhere. On-line financial services provided by credit history unions make it possible for participants to examine account equilibriums, transfer funds, pay bills, and watch deal history with just a few clicks.

Mobile apps supplied by additional hints credit scores unions further enhance the banking experience by offering additional versatility and access. Generally, credit history unions' on the internet banking and mobile apps encourage participants to handle their finances effectively and firmly in today's busy digital globe.

Conclusion

Finally, credit score unions use an one-of-a-kind financial experience that prioritizes community involvement, individualized solution, and participant satisfaction. With lower charges, affordable passion prices, and customized economic solutions, debt unions satisfy specific demands and advertise financial well-being. Their democratic structure worths member input and sustains neighborhood communities via various campaigns. By joining a credit scores union, individuals can boost their banking experience and develop strong relationships while enjoying the benefits of a not-for-profit banks.

Unlike banks, debt unions are not-for-profit organizations possessed by their participants, which frequently leads to reduce fees and much better rate of interest rates on financial savings accounts, lendings, and credit score cards. Furthermore, debt unions are understood for their individualized client service, with personnel participants taking the time to understand the one-of-a-kind economic goals and challenges of each participant.

Credit score unions typically offer economic education and therapy to aid members improve their financial proficiency and make educated choices regarding their cash. Some credit history unions might serve people that live or function in a particular geographical area, while others may be connected with particular firms, unions, or associations. Additionally, household members of current debt union members are often qualified to sign up with as well.